Blockchain Technology: So What’s the Big Deal? (and It Really is a Big Deal.)

Blockchain. It’s being called the next generation of the Internet – a technology that will have far-reaching effects across societies, world economies, and throughout business and industry. Recently, Retail Info Systems News called blockchain technology “the omnichannel-of-old buzzword of 2017” and others have identified it as one of the top retail trends to watch this year.

Could this be true? Omnichannel and the pivotal role it plays in retail is easily understood. Today, it’s table stakes. But blockchain technology? How could something that sounds like a video game be the technology most likely to change the next decade of business?

In researching our upcoming white paper on commerce trends and technologies, I stumbled through a maze of blockchain articles and explanations. What is this technology and why does it matter – or does it? How will the blockchain “revolution” change retail? The answers are complex – a tangle of technology, economics, and currency conversations. To help demystify blockchain, here are five things to know that will help you understand this transformative technology.

What is blockchain technology?

Picture a vast digital ledger or data base that keeps track of transactions. It is shared across a distributed network of computers – an encrypted registry that remains highly secure and tamper-resistant, and is replicated across all computers in the network. This is blockchain.

Networked users can access and manipulate the ledger. With each transaction that is shared across the network, the ledger is updated with a new “block” that’s added onto the end of the chain. All transactions are transparent.

Think of buying a house. Data or assets necessary for the transaction – the deed, for instance – are securely stored in the blockchain and are accessible to buyer and seller. The property’s transaction history is recorded on the blockchain, eliminating middlemen or painstaking and expensive due diligence required in a real estate deal. Title searches are eliminated. Trips to city hall are no longer required. Legal wrangling is reduced.

Of secret code and ciphers

Using blockchain technology, companies can make and verify transactions instantaneously – and without the intervention of banks, financial institutions or other trusted third parties. Cryptography – secret code and ciphers – ensures secure transactions. Writes Don Tapscott, one of the world’s leading authorities on the economic and social impacts of technology, “On the blockchain, trust is established, not by powerful intermediaries like banks, governments and technology companies, but through mass collaboration and clever code. Blockchains ensure integrity and trust between strangers. They make it difficult to cheat.”

One truth, many applications

There are three core components in a blockchain: a network of computers (brains), a network protocol (language) and a consensus mechanism (rules) to validate transactions. Once a transaction is authenticated, it is added to the networked ledger. What emerges in a supply chain, for instance, is a single version of the truth – a secure, immutable, and synchronized record of transactions about goods and component parts. Origin, authenticity, and movement can be traced up and down the supply chain.

Imagine a B2B brand buys goods to manufacture its top-selling item. A serious defect is discovered. Blockchain technology would enable the brand to pinpoint the precise origin of the flawed component, and quickly respond and remediate.

Think of this in the context of food supply – Walmart did. The mega-retailer turned to IBM to help it track two products using blockchain technology: a packaged produce item in the U.S., and pork in China. A blockchain co-developed by IBM is enabling Wal-Mart to record a list of transactions indicating how meat has flowed through a commercial network, from producers to processors to distributors to grocers and, lastly, to consumers.

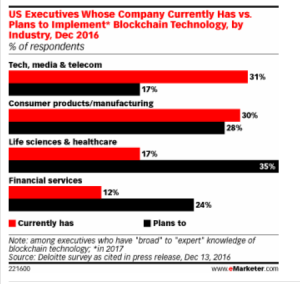

In fact, retail is one of the first industries to embrace blockchain technology – second only to financial services. Practical applications include protecting consumers and sellers from fraud – counterfeit items, for instance. One retail start-up plans to use blockchain to verify and sell items from artisans and designers. But according to the National Retail Federation, most applications in retail will revolve around payments as retailers seek ways to increase profits by reducing transaction costs.

In fact, retail is one of the first industries to embrace blockchain technology – second only to financial services. Practical applications include protecting consumers and sellers from fraud – counterfeit items, for instance. One retail start-up plans to use blockchain to verify and sell items from artisans and designers. But according to the National Retail Federation, most applications in retail will revolve around payments as retailers seek ways to increase profits by reducing transaction costs.

Today, more than 40 top financial institutions and a growing number of firms across industries are experimenting with blockchain technology as a secure and transparent way to digitally track the ownership of assets. Even healthcare providers are getting in on the action as blockchain is a perfect way to store and access medical records.

The origin of blockchain

First came bitcoin, then came blockchain. In 2008, Satoshi Nakamoto – the name assumed by the unknown person or persons who designed bitcoin – published a paper on bitcoin, a peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution. Transactions were recorded on the blockchain ledger. To ensure trust in the ledger, participants on the network ran algorithms – remember, secret code and ciphers – to verify digital signatures and add transactions to the ledger. This was the first application for blockchain.

Where to learn more

There is no shortage of information on blockchain technology. A Google search yields 13 million results on the topic. If you’re a novice, you’ll want resources that provide a basic understanding of the technology, and why and how it matters. Here’s a short list of content that paints a clear picture:

Videos

- Understand the Blockchain in Two Minutes

- How the Blockchain is Changing Money and Business (TED Talk)

- How the Blockchain Will Radically Transform the Economy (TED Talk)

Books

- Blockchain Revolution by Don Tapscott and Alex Tapscott

- Blockchain: Blueprint for a New Economy by Melanie Swan

Articles

- What is Blockchain (Wall Street Journal)

- The Truth About Blockchain (Harvard Business Review)

- Blockchain Consumerism (Shop!)

- Blockchain Tracker: Technology’s in Retail (PYMNTS.com)

- Top Five Retail Trends to Watch in 2017 (RIS News)