Chargeback Protection for eCommerce

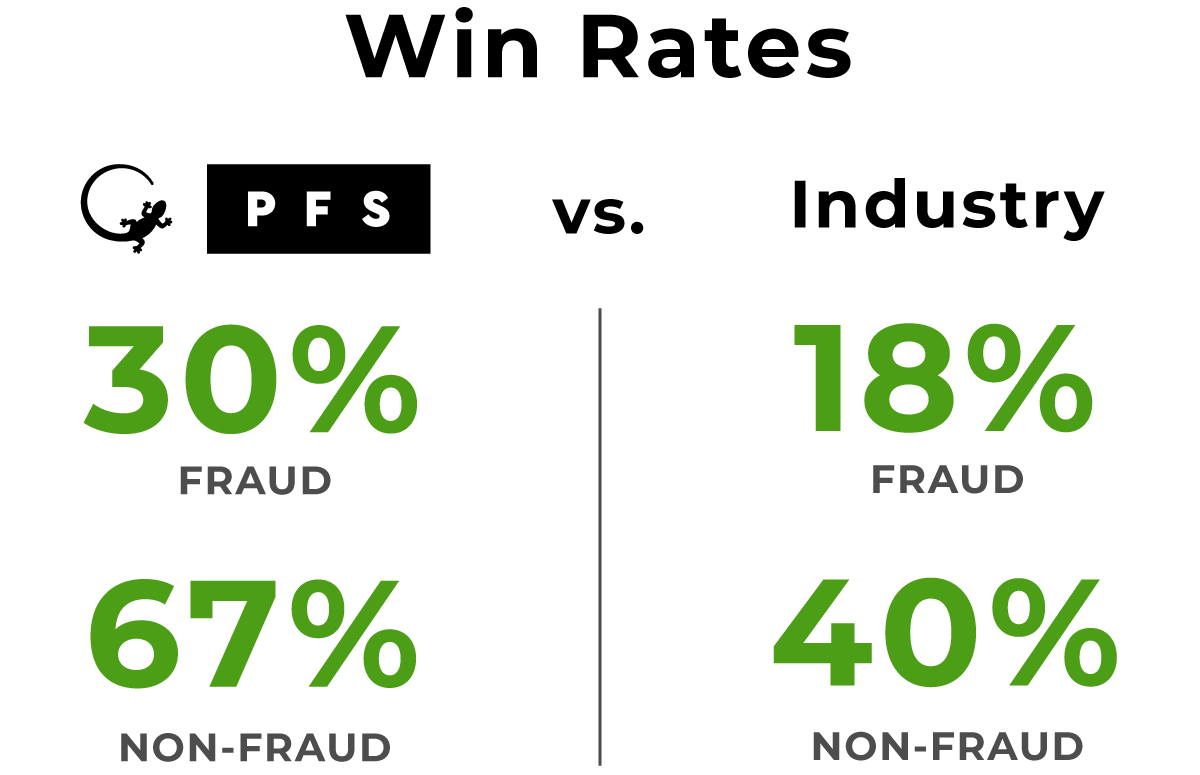

Achieve win rates above industry average with PFS.

Successful chargeback reversal is not a simple or straightforward task. Many retailers keeping these activities in house lack an accurate understanding of the many nuances involved in eCommerce fraud, friendly fraud prevention, etc. To simplify the task, some have attempted to automate chargeback reviews, only to cause further disruption that negatively impacts the overall customer experience.

Does your brand identify with the following struggles?

- Low win rates

- Low recovery rates

- Slow response times

- Staffing shortages

- Lack of fraud knowledge

Start winning with PFS

PFS’ above average win rates push back on the “you’ll never win” narrative around disputing chargebacks. Our chargeback management professionals have the experience and knowledge to handle disputes in a manner that protects you from fraud and non-fraud chargebacks and generates revenue.

We don’t block sales. We add to the bottom line.

PFS offers proven friendly fraud prevention strategies and dispute management expertise. With minimal start-up time and no integration requirements, our chargeback management services help brands like you fight back. Working closely with you to understand your unique business parameters, taking into consideration everything from product type to customer demographics, we define and execute effective chargeback strategies that work.

How is PFS able to do it better?

We apply a combination of system integrated services and manual review techniques that are essential to our above-average win rate. Incorporating knowledge gained through 25+ years managing the entire eCommerce lifecycle, our review process gives us a unique purview on how to compile and analyze the data to successfully achieve chargeback reversals.

Leveraging a tier 1 PCI compliant setup combined with your payment processor, fraud tools and CRM or OMS, we ensure highly effective dispute management, complete with:

- Fast response times

- Win rates above industry standards

- Support for all card types

- Detailed reporting and data analysis

- Support for traditional and non-traditional payment methods

Industry knowledge + Fraud Experience

While managing fraud prevention in-house, this lifestyle apparel brand was operating a fraud strategy focused solely on lowering chargeback rates, resulting in an above average decline rate that was having a visible impact on their bottom line.

Applying a combination of industry knowledge and fraud expertise, PFS designed a holistic strategy unique to the brand’s requirements. The new strategy incorporated customer demographics, shopping habits and more. The results saw an increased approval rating of 8% and a 28% YoY increase in net revenue. The improved customer experience also reduced customer service volume, lowering operating costs.

Retailer chargeback support

As a 3PL specializing in both DTC and B2B fulfillment, our chargeback services include B2B solutions as well. We understand the importance of routing guide requirements and design our solutions to ensure compliance during B2B fulfillment. With automated checks and balances built into the PFS WMS, the system requires completion and validation of each step of the process before moving on to the next step. Automated system checks also validate cartons against orders, confirm UCC labels are readable, etc.

Start fighting back

Fill out the following form to speak with a chargeback prevention expert and learn more about how your brand can benefit from PFS’ chargeback management services.

EXPLORE OUR OTHER SERVICES

Learn more about our carefully crafted offerings and extensive experience in the industry.