PFS Research – COVID-19 Has Kick-Started a New World Order for Retail

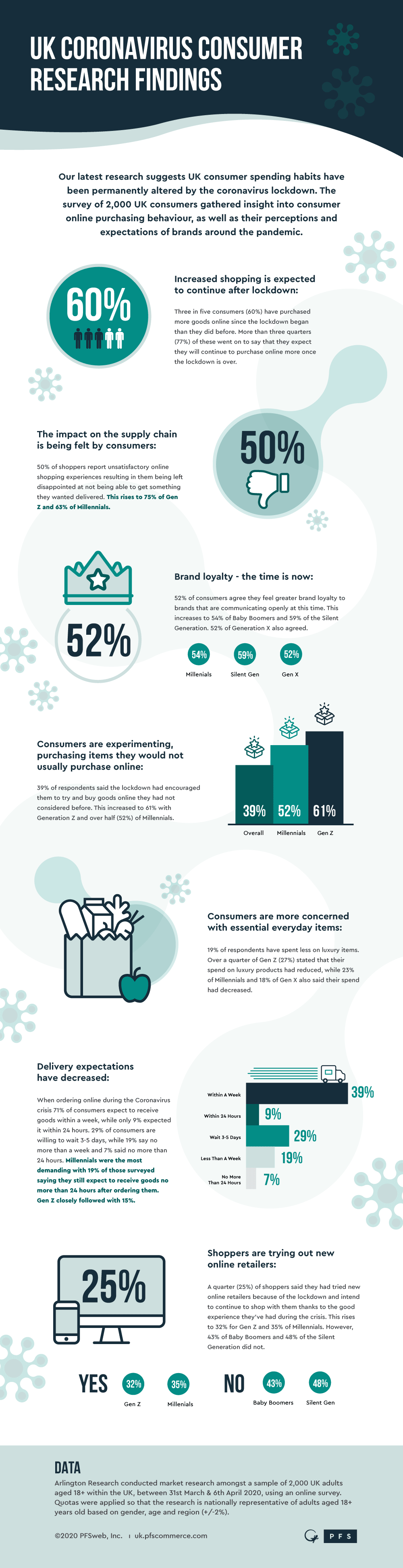

The shopping habits of UK consumers have been permanently altered by the coronavirus lockdown, our latest research has found. PFS surveyed 2,000 consumers to understand their purchasing behaviour during the lockdown, as well as their perceptions and expectations of brands and retailers around the pandemic.

We’ve broken the findings down into three sections; consumer behaviour, consumer perceptions, and delivery times. At the bottom of this page, we’ve also created a handy infographic of the stand-out learnings. Please feel free to comment and share. We hope this research will be useful in helping you steer your business through this crisis.

-

Consumer behaviour

The survey found that three in five (60%) consumers have purchased more goods since the lockdown began, than they did before, with 53% having shopped more online. More than three quarters (77%) of these went on to say that they expect they will continue to purchase online more once the lockdown is over – indicating a potentially irreversible change in consumer purchasing behaviour.

This clearly indicates the shift from brick-and-mortar to eCommerce has been drastically accelerated due to the lockdown. It has also meant that some brands and retailers were ill-prepared for the change in purchasing patterns, resulting in the development of entirely new omnichannel strategies and business model pivots in order to ensure business continuity.

39% of respondents also reported that they had been encouraged to purchase products online that they had not considered before, such as pet food and footwear, which increased to 61% for Generation Z and over half (52%) of Millennials – good news for online retailers. Conversely, 50% of shoppers report unsatisfactory online shopping experiences resulting in them being left disappointed at not being able to get something they wanted delivered. This rises to 75% of Gen Z and 63% of Millennials.

Perhaps unsurprisingly, over a third (36%) of consumers have struggled with online grocery deliveries in particular, having tried to get a delivery slot, but failed.

When it comes to non-essential items, a quarter (26%) say that their purchasing of clothing online had decreased, whilst 18% have bought fewer cosmetics and luxury goods online since the lockdown. Purchasing of technology has also decreased for 19% of all respondents. Over half (53%) did concede that they are spending less on fashion as they aren’t going out – the impact of which the fashion industry is most definitely feeling.

Meanwhile, 19% report they have increased their purchasing online of healthcare items, and a quarter (25%) of Millennials have increased their purchasing of home, garden and DIY products online.

-

Consumer perceptions

When asked about their perceptions of brands’ responses to the pandemic, 52% of all consumers agree that they feel greater loyalty towards brands that effectively communicate with them and are demonstrating responsibility and holding their business accountable to helping people during this time. This increases to 54% of Baby Boomers and 59% of the Silent Generation.

A quarter (25%) of shoppers said they had tried new online retailers because of the lockdown and intend to continue to shop with them thanks to the good experience they’ve had during the crisis. This rises to 32% for Gen Z and 35% of Millennials. However, 43% of Baby Boomers and 48% of the Silent Generation didn’t.

Another statistic, that brands and retailers should take heed of, is that over half (54%) of UK online shoppers report they will be less likely to spend money with brands and retailers in the future that have treated their staff poorly during the coronavirus.

-

Delivery times

Whilst expectations on delivery times have eased slightly, consumers still expect their items to reach them quickly during this challenging period. Seven in ten (71%) shoppers expect their items to reach them within a week (compared to 90% normally). Breaking this down further, 14% expect their items to be delivered in no more than two days during the lockdown (compared to 29% normally) and 29% expect deliveries to take no more than 3-5 days (compared to 36% normally).

Our Executive Vice President & General Manager, Zach Thomann, had this to say about the findings “The research identifies that the coronavirus pandemic and subsequent lockdown will have a lasting impact on the shopping habits of UK consumers. Other than for groceries, people in the UK have had no alternative but to shop online to get what they want, with many consumers looking to online shopping to alleviate boredom. Many have liked this new experience and intend to continue to shop this way, even after the lockdown has ended. Brick-and-mortar retailers need to prepare now for this forced acceleration in the migration to online shopping.

“Our findings also show that consumers will both reward and punish brands in accordance with their response to the pandemic. Those that are there for their customers, staff and the community will be rewarded with brand loyalty and repeat purchasing. Shoppers will turn away from brands that are not behaving ethically during this period though and are likely to vote with their wallets in favour of more trustworthy competitors. There really is no excuse for not being a responsible company. We are seeing the beginnings of a new world order for retail. It’s vital that business leaders think about the long-term implications of the lockdown and not just the short-term impact of our current restrictions. Please feel free to get in touch with us to discuss the findings further and to look at how we can help you navigate the challenges ahead.”