Legacy to DTC: Retail’s New Cool Factor

Part One: The Shifting Face of CPG

Over the last decade, a common theme that has transcended the retail sector is disruption. We have seen a monumental shift away from brick-and-mortar towards eCommerce, as the Amazon Effect has driven a sharp change in consumer expectations. With recent technological advances, consumers have quickly become accustomed to a certain level of personalization in their commerce. The rise of the Direct-to-Consumer (DTC) retail model has tapped into this concept and seemingly taken over the industry by storm. Many legacy brands have struggled to adapt the way many new, digitally native brands have, and shoppers are taking notice.

This series will explore DTC – retail’s new cool factor – and the challenges for how legacy brands can keep pace in today’s retail environment. To start, we’re taking a look at how many legacy Consumer Packaged Goods (CPG) companies are reconfiguring their operations to meet shopper demand.

A Shift in the Market

Historically, CPG brands have followed a similar template to consumer adoption. Many of the key players in the space have been established for generations with a loyal following, brand recognition and a superior product. Traditional media channels were used to direct shoppers to big-box retailers to purchase their products. Over time, many legacy brands gained a significant share of aisle space across the country. This strategy seems simple enough, though retail does not stay stagnate for long. As commerce shifted online, the channels for sales and marketing began to blur. DTC brands were able to sell products in the same place customers learned about them. In fact, E-marketplaces generated 70 percent of all consumer-goods sales growth between 2013 and 2018. (1)

However, for CPG manufacturers, once their product hits the shelves, they lose control of the customer experience. They can no longer guide the in-store experience, and everything that a customer does from the moment they pick out an item, check out and head to their car is out of the brand’s hands. Legacy brands become reliant on a Walmart or CVS for a seamless customer experience, where the DTC model has changed how customers interact with brands entirely. Case in point, understanding changing customer needs is an extremely valuable asset. A Deloitte survey revealed 62 percent of retailers that invested in customer analytics saw a clear ROI and 52 percent witnessed an increase in revenue. (2) This new roadmap should start and end with a focus on the customer allowing for seamless channel management.

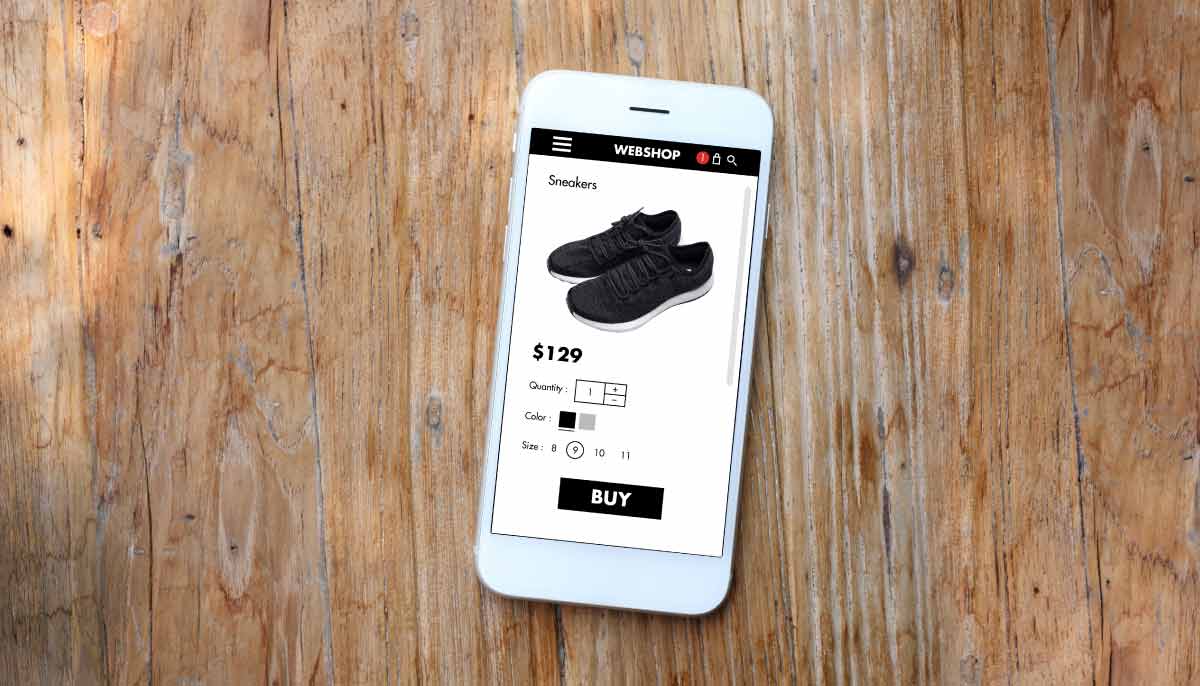

Shoppers now demand that every touchpoint of commerce is personalized and seamless. This stretches from the way they are targeted in digital advertisements, to the layout and UX of an eCommerce website, to ease of checkout and speed of fulfillment. CPG brands are expected to control the entire customer experience from start to finish, leveraging digital channels to make shoppers feel connected to a specific brand. However, channel conflict and lack of customer ownership present a major challenge to CPG brands trying to accomplish this. Retailers need to bridge the gap between digital and physical experiences or risk losing more ground to DTC. So, what can be done?

Forging a New Path

The good news is that CPG brands have a few options. They can take on the costly undertaking of purchasing an overvalued DTC unicorn and absorb the brand and their operations into their own umbrella; just like Unilever’s $1 billion acquisition of Dollar Shave Club. (3) Or, they can look to launch their own DTC venture to drive more revenue to their bottom line. However, this is difficult for many CPG brands to take on alone, as many legacy systems aren’t built to support the type of operations needed to successfully fuel a DTC brand. Luckily, end-to-end partners can help alleviate some of these growing pains and get DTC offerings off the ground. Legacy retailers have the products to drive consumer adoption; they just need help creating the brand and processes that connect the digital shoppers to physical products.

This involves building out standardized packout processes, scaling fulfillment and developing payment as well as customer care solutions. Retailers must ensure that each touchpoint for the shopper is seamless and every consideration has been made. Supply chains must be tweaked to allow for rapid turn-around time for products, which can be a new concept for many legacy brands. The harsh reality is that 46 percent of shoppers will abandon an online cart if shipping times are too long. (4) Legacy retailers need a solution in place to ensure fulfillment is efficient and shoppers’ expectations are met.

While legacy CPG brands have an uphill battle to close the DTC gap, all is not lost. CPG covers a significant share of the market and their access to consumer data is second to none. With the right approach and attention to channel management, many legacy retailers can start to see significant growth when it comes to new consumer adoption. The channel and audience may be shifting, although the purpose remains constant. CPG brands have gotten to where they are for a reason; now, DTC represents a way to ensure their legacy lives on.

- https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/is-the-consumer-goods-industry-ready-for-the-new-world-of-work

- https://www2.deloitte.com/us/en/pages/consumer-business/articles/consumer-products-industry-outlook.html

- https://fortune.com/2016/07/19/unilever-buys-dollar-shave-club-for-1-billion/

- https://www.mckinsey.com/industries/retail/our-insights/same-day-delivery-ready-for-takeoff