What COVID-19 Has Taught Us About eCommerce Spending

Despite spikes of COVID-19 cases in certain parts of the country, some brick-and-mortar retailers are gearing up for limited reopenings. Malls and grocery stores will likely be less crowded than before with new safety protocols in place. Although some shoppers will be looking forward to returning to their favorite brick-and-mortar retailers, others may now be inclined to still shop from the comfort (and safety) of their couch. What couldn’t be any more apparent is COVID-19 has caused a significant shift towards eCommerce that may linger, well after social distancing policies are lifted.

However, these consumer shopping behaviors vary from shopper to shopper and even between retail segments. For example, millennials and baby boomers have exhibited far different shopping activities, and the channel preferences for shoppers buying groceries versus consumer electronics also varies.

To truly gauge how consumer behaviors have pivoted among retail categories and demographics, PFS recently surveyed 2,000 US consumers. The research reveals certain retail categories have seen a surge since the forced move to eCommerce, while others are anxiously awaiting the return to brick-and-mortar shopping. As well, age and gender play a significant role in determining retail behaviors and exploring the changes COVID-19 has presented across different demographics.

Consumable Retail Goods See an eCommerce Surge

Since the onset of COVID-19, many consumers have been forced to use online shopping as their sole retail channel. This change put a strain on global supply chains, while leaving lasting impacts for merchants across many retail segments. This has also led to changes in consumer brand preferences, due to online availability. Our recent survey looked at how shopping behaviors fluctuated across the following retail categories:

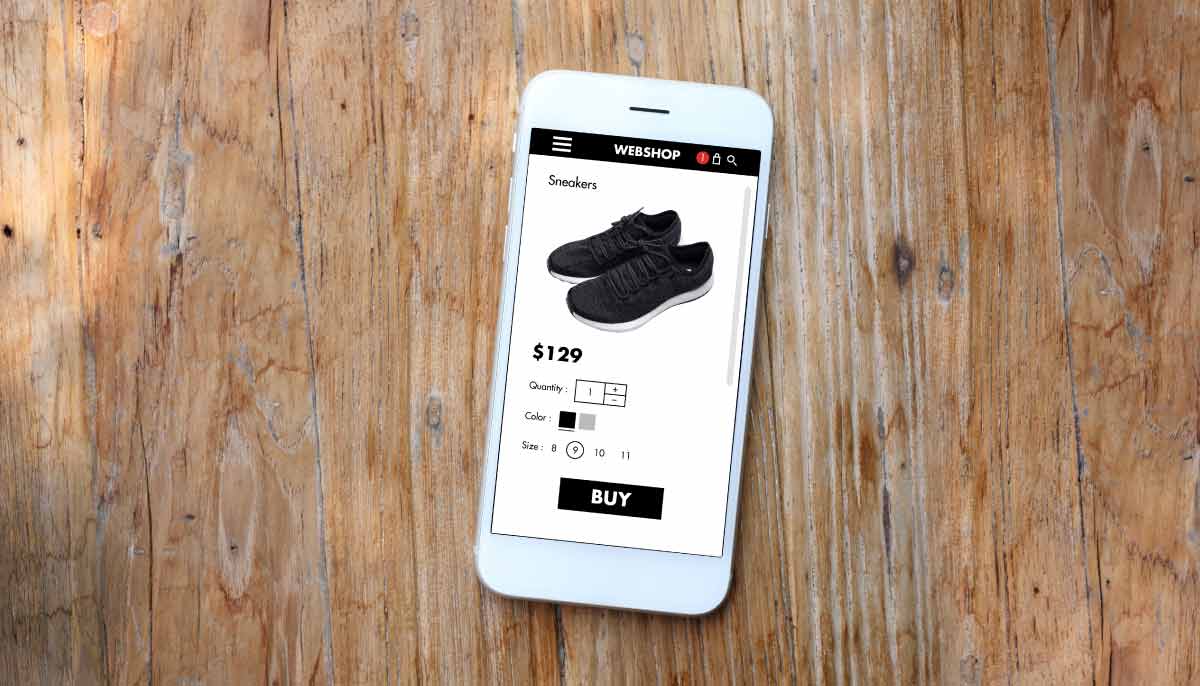

- Apparel and Footwear

- Jewelry

- Health and Beauty

- Office Supplies

- Consumer Electronics

- Groceries and Household Products

- Home and Garden.

Looking across these categories, our data shows it is clear that consumable goods have seen an increase in eCommerce volume since the start of the pandemic. There is a sizeable gap between the groceries/household items and health and beauty categories compared to the other market segments. Though it is worth noting that online purchases in home and garden appear to have stayed neutral. This could be due to the essential nature of consumables like groceries and a lack of eCommerce adoption for the retail segment prior to the pandemic.

COVID-19 also influenced change across eCommerce websites and the online retailers’ consumers shop with due to several factors like availability and delivery times. Across all categories, over four in ten consumers have shopped with online retailers/websites they haven’t used before, increasing to 58 percent of jewelry shoppers during the pandemic.

Because of a perceived lack of availability, consumers are also ordering items earlier than usual to allow for longer delivery times. This is the case for 40 percent of shoppers across all categories and rises to 47 percent in jewelry and 50 percent for groceries/household items.

Younger Consumers Embrace Online Shopping Channels

The impacts of COVID-19 can also be looked at through the lenses of various demographics. Unsurprisingly, younger consumers lead the way in eCommerce shopping. Across all demographics surveyed, baby boomers and the silent generation are the least likely to have shopped with a new online retailer or website during the pandemic. On the other hand, 75 percent of millennials have bought goods online during the pandemic that they had not considered prior, while 56 percent of millennials have tried at least one new brand during the pandemic.

Looking further, 46 percent of millennials and Gen Z have more online grocery purchases than usual amid the pandemic, compared to just 28 percent of baby boomers and the silent generation. These figures are 35 percent for millennials and Generation Z and 15 percent baby boomers/silent generation for the health and beauty category, revealing younger shoppers lead the way in eCommerce usage.

Additionally, 62 percent of Gen Z have shopped with new online retailers and websites for home and garden products, compared to just 32 percent of baby boomers and the silent generation. This compares to 55 percent of millennials and 28 percent of baby boomers/silent generation for apparel and footwear.

Also worth noting is the shifts in shopping behaviors based on gender. Men are more likely to buy more online products and shop with new online retailers and websites during the COVID-19 pandemic than women. This could be due to a lack of eCommerce adoption for men prior to the pandemic, where social distancing has forced a quick shift in channel preference.

Social distancing has transformed the way that many consumers choose to shop. Breaking down these behaviors by retail segment and demographic paints a much clearer picture of what has changed due to the pandemic, and what commerce will look like moving forward. Some market categories like consumables have benefited from the shift to eCommerce more so than other categories, and only time will tell if these behaviors will stick after the pandemic. These insights prove that, moving forward, merchants must build new strategies that cater to different market segments and demographics.

See what else we learned from this study in our previous posts, Shifting US consumer behavior in the face of COVID-19 and Coronavirus Consumer Research: US VS UK.