COVID-19: There Is Hope for Fashion Yet

Although the fashion landscape currently looks bleak, there may be hope for fashion, luxury and beauty yet, as individual sectors begin to show signs of lifting. Long term, COVID-19 might bring about more conscientious buying behavior and ignite sustainable consumerism.

While stores are closed, eCommerce’s doors remain open. But with events and social gatherings canceled, are consumers still in the market for fashion? Online fashion retailers have reported a 23% year-on-year decline in sales for the month of March. Our recent consumer survey conducted in the UK found that when it comes to non-essential items, a quarter (26%) of consumers say that their purchasing of clothing online had decreased; only 9% say that it has increased. As for cosmetics and luxury goods, 18% of consumers said they have bought less online since the lockdown. It’s easy to sympathize with Next Chief Executive, Lord Simon Wolfson’s pessimistic outlook, “people do not buy a new outfit to stay at home.” Indeed, our research confirmed that over half (53%) of consumers did concede that they are spending less on fashion as they aren’t going out – the impact of which the fashion industry is most definitely feeling.

Moreover, operational hurdles have left the fashion industry in tatters. Supply issues in China, the largest growth market for Luxury, sent export operations spiraling, catalyzing a knock-on effect right through the industry chain. Primark and Matalan have allegedly canceled £2.4bn worth of orders, leaving factories to sink the costs and more than a million Bangladeshi garment workers sent home without pay. Orders from Italy, principal producers of luxury leather, jewelry and fashion goods, have also been revoked by overseas brands. Fittingly, Milan Fashion Week – the hub of creative inspiration – was canceled.

However, recent developments suggest fashion has not reached the end of the runway yet. We found that, although a quarter of UK consumers say that their purchasing of clothing online has decreased since the COVID-19 lockdown, 58% say their spend remains unchanged. This is huge news for retailers, and a far cry from the devastating abandonment of fashion which had been predicted.

Taking a closer look

Below, we highlight several individual product sectors that are beginning to turn, including:

- Loungewear

- Beauty

- Lingerie

- Athleisure and Sportswear

- Footwear

- Gifting: Fashion Accessories and Jewelry

Brands within these sectors who are creative, innovative and digital may just carry the fashion industry through.

Loungewear

Consumers’ weekday, evening and weekend outfits have merged into one. Just as consumers might purchase a new outfit with the news of a new job, a dramatic change of lifestyle warrants a new wardrobe. Consumers want to feel comfortable at home.

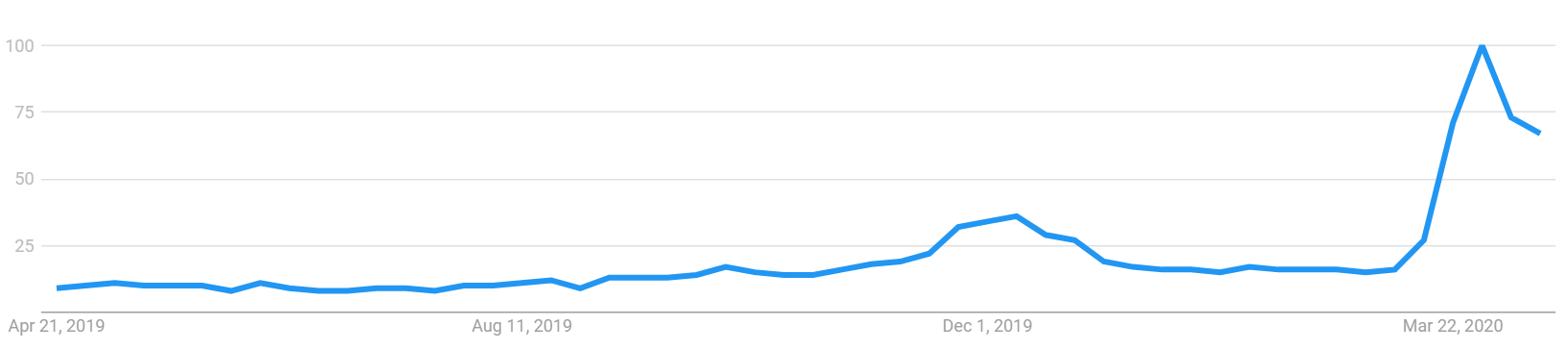

As seen in the following Google Trends analysis as of April 21st, 2020, searches of ‘loungewear’ continue to escalate worldwide.

Beauty

Health and Beauty is rocketing. Surprisingly, the sector is not being carried solely by health-products (such as sanitizer and vitamins) – beauty products are also seeing a significant rise, up 123% from this time last year.[1] Our research shows that, although 18% of respondents decreased their spend on beauty and cosmetics, over half said their spend stayed the same. Notably, we saw a significant increase in spend in younger consumers: Generation Z and Millennials increased spend by 16% and 17% respectively. Aside from conference call glow-ups, the reason for high demand for makeup is unclear, suggesting purchase behavior is not only driven by rational needs – the ‘Lipstick Effect’, supported by former John Lewis managing director (who noted that lipstick sales increased as financial uncertainty grew), says that in times of difficult economic conditions, consumers cut back on big-ticket items but treat themselves to smaller luxuries such as lipsticks. A shift towards emotional investments, luxury and joy-enhancing shopping may be on the way.

Lingerie

One sector has taken a surprising U-turn in recent weeks: lingerie sales are now up 38% year-over-year.[1] This is partly due to brick-and-mortar retailers shifting to eCommerce. It seems that as people settle in for a cozy summer, they are revamping their wardrobes to impress behind closed doors.

Athleisure and Sportswear

Since confinement to the home has become mandatory, daily movement has decreased by up to 38% in some European countries: consumers are beginning to notice they are missing light daily activity, such as walking around the office or shops, and are seeking means to compensate for lost steps at home. With more time to work out (and with motivation boosted by the surplus of fitness-related social content) athleisure gear is booming.

Footwear

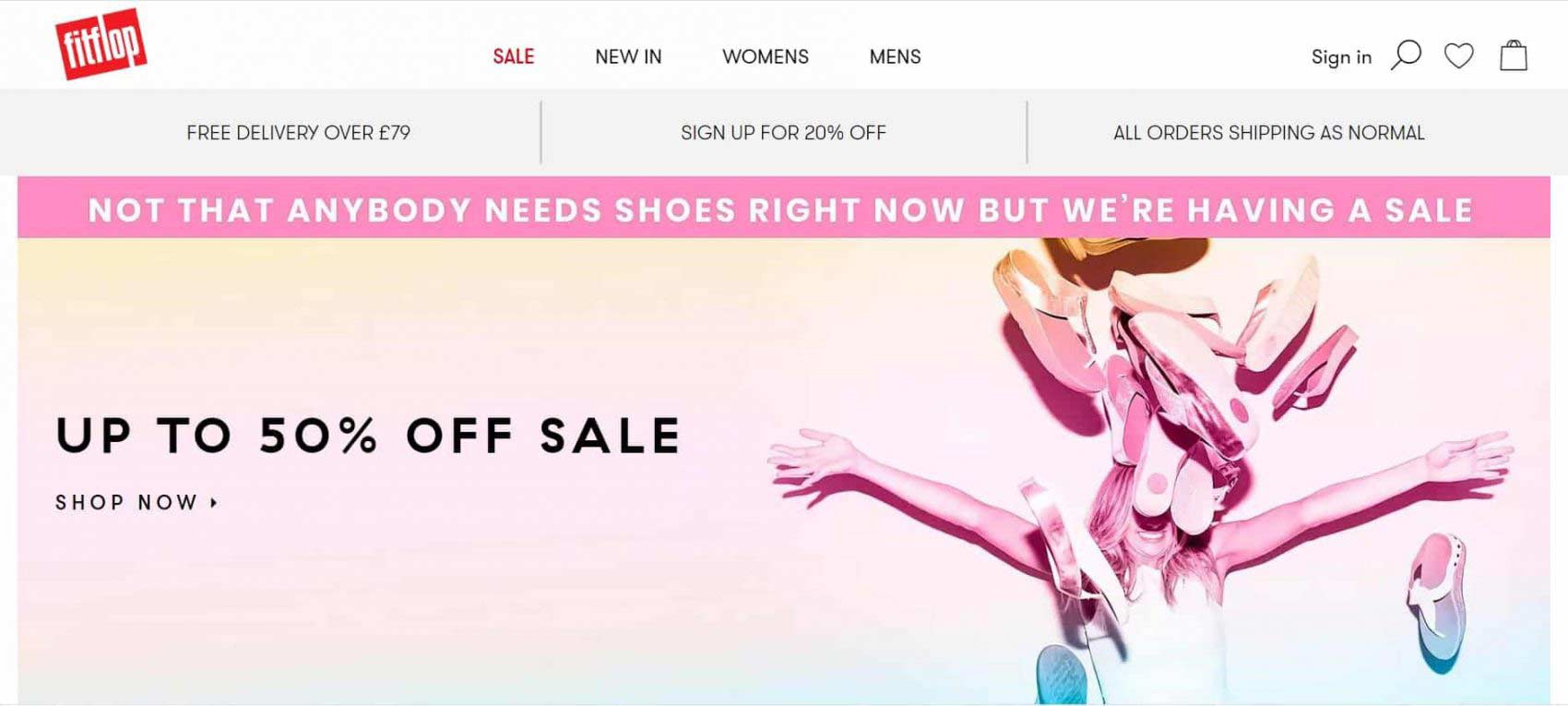

Our research found that a quarter of all consumers had decreased their spend on footwear, while only 6% stated their spend had increased. This is no surprise, as brands such as Fitflop have jested in their own advertisements.

Although this category will undoubtedly suffer, 12% of both Generation Z and Millennials actually increased their online spend. Promisingly, 39% of all respondents also said they had been encouraged to purchase products online that they had not considered before, including footwear, which increased to 61% for Generation Z and over half (52%) of Millennials.

Gifting: Fashion Accessories and Jewelry

Gifting is up 75% year-over-year.[1] With a ban on socializing outside of the household, consumers are finding other ways to show they care. Additionally, as people are spending more time at home, they have more disposable income to spend on gifts, as well as more time to browse online. eCommerce is providing a valuable service during this time, safely delivering thoughtful gifts to family and friends, contact-free. Products such as fashion accessories (up 17% YoY) and jewelry are proving to be popular gift items. [1] Brands who offer personalization, engraving, branded gift wrap and high-end pack-out, as well as eGift Cards, are winning this market.

Sustainable Fashion Revolution

COVID-19 could ignite a permanent shift away from fast-fashion towards sustainable consumerism.

With spend on redundant clothing (such as eveningwear and footwear) reduced, consumers are willing to spend more on the sectors and products they do desire, shifting attitudes away from cheap, throwaway fashion towards high-quality, luxury and sustainable garments. This attitude is likely to be maintained even after the coronavirus outbreak: when spend on fashion eventually bounces back, we may see a permanent shift in behavior – amplified by our increased disposable income. As the fashion industry emits more carbon than international flights and maritime shipping combined, a shift away from fast-fashion will be welcomed by the planet.

Digital evolution

We are unlikely to see a backwards movement to brick and mortar; storefront operations may not fully recover to what they were before. The shift to eCommerce has opened consumers’ eyes to a world significantly more digital in a post-COVID world. Are you needing help embracing the new retail landscape in light of COVID-19? Find out more about how we can help here.

[1] IMRG Capgemini Online Retail Index, 16th April 2020